Project Darby Portfolio – Nationwide

Make an enquiry

Completed a landmark deal acting on behalf of Paloma Capital to acquire West Midlands-focused industrial and office landlord RVB Investments from an overseas family for about £90m acting jointly with Andrew Dixon & Co.

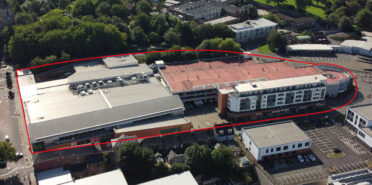

RVB, which was established in 1975 and owned 32 warehouse and eight office assets that produced a rent of £7.1m a year.

The deal is a milestone for Paloma Capital, which was co-founded by Joe Froud and Jack Pitman in 2015. Froud said the fund manager had been working on the transaction for eight months.

“Despite our experience in corporate transactions it was a complex process involving a 42-year-old firm with a portfolio of multi-let assets,” he said. “However, these are exactly the sort of assets that we are targeting for our warehouse strategy.”

The properties are spread across the UK but the majority are located around Birmingham and the West Midlands, with a particular concentration in Telford. They have an average unexpired lease term of 4.5 years.

Paloma completed the purchase on behalf of its debut fund, Paloma Real Estate Fund I, which raised £140m in June, giving it firepower to invest £300m. As a result of the deal, 90% the fund has now been committed. Paloma’s acquisition of RVB was financed by two of its existing lenders – Santander on the warehouse assets and RBS on the offices.

The vendor was advised by EY and Mills & Reeve.

View other portfolio transactions.